Behavioral Economics & HYPObolic Discounting

In 2014, I traveled to Italy for my first time. The moment I arrived I overindulged in a massive 3 course meal at Trattoria Milanese, over tipped, and left my credit card. Besides that unforgettable dining experience, what remains from my Italy trip is 2 uncorked bottles of merlot from Montepulciano.

THE DOMINATE FINDING: Present Bias & Eating Pizza

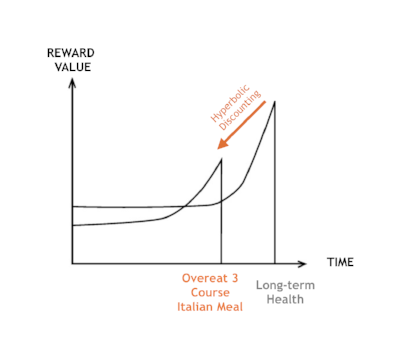

My irresistible urge to devour a 3 course Italian meal follows what behavioral economists call hyperbolic discounting, which simply means I discounted the future for the present. In other words, I chose to overindulge on lots of delicious pizza in the moment instead eating a ‘healthy’ portion (a decision to benefit future health).

Most consumer decision-making is dominated by this finding that people sharply reduce the importance of their future in their decision making (Ainslie, 1975).1 They are ‘present biased’, prefer things here and now as opposed to something more rewarding or healthier later. Some prominent examples of present bias include: watching tv now, gym later; eat cake instead of kale; spend now, start saving tomorrow, 1 marshmallow now instead of 2 next week (Mischel et al., 1989).2

A NEW PERSPECTIVE: Uncorked Wine & Value of Delayed Consumption

The 2 bottles of wine from Italy I have been saving for the ‘right’ women. Saving the wine for a future girl (which looks unlikely right now) is largely inconsistent with the dominate finding in behavioral economics. Instead of uncorking and consuming the wine now (hyperbolic discounting), I am doing the opposite which exhibits ‘hypobolicdiscounting’, a willingness-to-wait (Eil, 2012).3

Future bias occurs much more often then we think, especially in today’s highly uncertain environment.

People not only overvalue the present and consume immediately (present biased), BUT ALSO can be ‘future biased’ and prefer to delay consumption. It happens much more than we think. For example, have you ever booked a vacation for a later date (instead of immediately), held onto gift cards instead of using them, or maybe decided to fill your Amazon shopping carts to wait for the ‘right moment’. These decisions to delay illustrate that not all desired outcomes are not always discounted with time (Loewenstein, 1987).4 Instead of buying we wait and we savor them!

Modeling Choice Requires Understanding Anticipation

One of the evolutionary hallmarks of humans is our ability to care about our futures. To put this in perspective, monkeys, one of closest evolutionary relatives, are unable to wait more than 8 seconds to triple the value of an immediate reward (Stevens et al., 2005).5 Humans undoubtedly share with other animals this hyperbolic time discounting but we also have the capacity to make decisions that take account of a much longer span of time. Our ability to see into the future gives meaning to ‘survival of the fittest’.

2 Distinct Components of Choices

- Anticipating Futures. Choices depend on our ability to anticipate future consequences. Without our ability to anticipate we would not see the repercussions of eating cookies for dinner everyday or see any value in investing for our future. All choices involve anticipating the potential future outcomes of the decisions.

- Resisting Temptations. Short-term temptations pervade the environment which undermine our ability to implement that decision.

Any successful model of intertemporal choices should incorporate features that accurately describe the tug of war between long-run (‘virtuous’) intentions and short-run temptations. Gal Zauberman (2016)6 elegantly summarizes many of these psychological factors and we will highlight relevant ones for consumer research.

Psychological Factors Influence Discounting

- Study Designs Influence Decisions: Many researchers implicitly assume research designs do not affect individuals’ choices. However, this assumption is not consistent with the seminal work of Tversky and Kahneman (1986) on framing. For instance, Eil (2012) conducted this brilliant experiment by asking willing to pay (WTP) and also their willingness-to-wait and showed hyperbolic discounting is sensitive to question context, if not entirely a result of it. Choices are not purely part of preferences, but are discounted by the experimental design.

- Time Perception is Elastic: Human time perception does not follow a static, fixed scale. At work time may “drag” or it “flies by” when on vacation. We have all heard, “be there in 5 mins” or “see you in one week” and know people interpret time differently. Empirical data shows “today” doesn’t have the same weight as any other day, and affects the output of decisions (Lucci, 2013).7 Intertemporal choice models would benefit from considering people’s subjective perceptions of time. (See Zauberman, 2009)8

- Mental Energy Matters: Making a grocery shopping decisions after long day of work is very different than making the same decisions in the morning. Anticipating the future costs/benefits or resisting temptations has energy requirements (Baumeister, 1998).9 All decisions are intimately tied to our mental energy (ego depletion) and choice models would benefit from accounting for energy status within them.

- Choices are Context Dependent. What do you prefer to drink? vs. What do you prefer to drink at the beach, bar, office or home will likely result in different answers irrespective of taste. Choices do not exist in vacuum but are largely context driven and highly susceptible to social influence. Choice experiments need to incorporate more context into their designs (See Berger et al., 2009 & John et al., 2011).10 11

- Multidimensional Outcomes. Most intertemporal preferences involve not only cost/benefit trade offs but also multiple outcomes in interest. For instance, profit maximizing investment bankers may make decisions trade-offs to favor their bank accounts, whereas later in life these decisions may change to happiness or philanthropic pursuits (“what should I do with all this money”). The point is the primary source of value or outcome dimension we seek to maximize, whether utility or happiness, or a combination of both should be accounted for.

Citations

- Ainslie, G. (1975). Specious reward: a behavioral theory of impulsiveness and impulse control. Psychological bulletin.

- Mischel, W., Shoda, Y., & Rodriguez, M. L. (1989). Delay of gratification in children. Science.

- Eil, D. (2012). Hypobolic discounting and willingness-to-wait. Unpublished Manuscript.

- Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. The Economic Journal.

- Stevens, J. R., Hallinan, E. V., & Hauser, M. D. (2005). The ecology and evolution of patience in two New World monkeys. Biology Letters.

- Zauberman, G., & Urminsky, O. (2016). Consumer intertemporal preferences. Current Opinion in Psychology.

- Lucci, C. R. (2013). Time, self, and intertemporal choice. Frontiers in Neuroscience.

- Zauberman, G., Kim, B. K., Malkoc, S. A., & Bettman, J. R. (2009). Discounting time and time discounting: Subjective time perception and intertemporal preferences. Journal of Marketing Research.

- Baumeister, R. F., Bratslavsky, E., Muraven, M., & Tice, D. M. (1998). Ego depletion: Is the active self a limited resource?. Journal of Personality and Social Psychology.

- Berger, J., Meredith, M., & Wheeler, S. C. (2008). Contextual priming: Where people vote affects how they vote. Proceedings of the National Academy of Sciences.

- John, L. K., Acquisti, A., & Loewenstein, G. (2010). Strangers on a plane: Context-dependent willingness to divulge sensitive information. Journal of Consumer Research.

- Berns, G. S., Laibson, D., & Loewenstein, G. (2007). Intertemporal choice–toward an integrative framework. Trends in cognitive sciences.

- Marshall, A. (1891). Principles of Economics. 2nd ed. London: Macmillan.